Triangle Pattern

Description

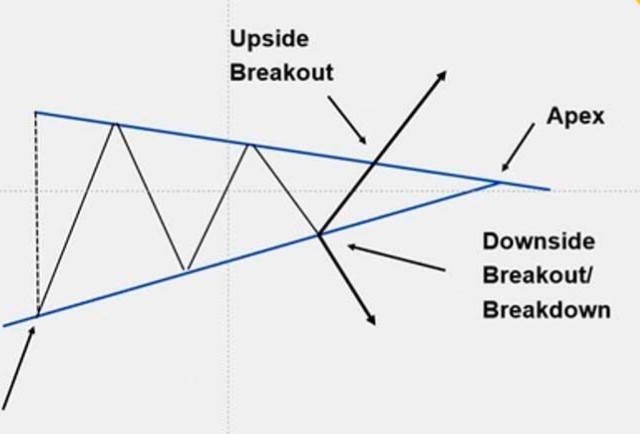

A triangle, also known as a coil or symmetrical triangle, is a chart pattern characterized by two converging trendlines connecting a series of sequential peaks and troughs. This pattern represents a period of consolidation before price breaks out in either direction. Unlike ascending or descending triangles, the symmetrical triangle doesn't have an inherent bullish or bearish bias.

How to Identify

- Look for a series of lower highs forming a descending upper trendline.

- Simultaneously, identify a series of higher lows forming an ascending lower trendline.

- The two trendlines should converge towards a point, forming a triangle shape.

- The pattern should contain at least two swing highs and two swing lows.

- Volume typically decreases as the pattern progresses and often increases on the breakout.

Trading Strategies

Breakout Trading

The most common strategy is to enter a position in the direction of the breakout.

- Long Entry: When price closes above the upper trendline

- Short Entry: When price closes below the lower trendline

- Stop Loss: Just inside the opposite side of the triangle from the breakout

- Take Profit: Project the height of the triangle from the breakout point

Anticipation Trading

More aggressive traders might enter positions near the trendlines, anticipating a bounce.

- Long Entry: When price approaches the lower trendline

- Short Entry: When price approaches the upper trendline

- Stop Loss: Just outside the trendline that was tested

- Take Profit: At or near the opposite trendline

Risk Management

Symmetrical triangles can break out in either direction, so it's crucial to wait for confirmation before entering a trade. Be aware of false breakouts, which are common with this pattern. Consider using a time stop to exit the trade if a breakout doesn't occur within a reasonable timeframe. The closer the price gets to the apex of the triangle, the less reliable the pattern becomes.

Example

In this example, we can see the price forming a series of lower highs and higher lows, creating converging trendlines. The price eventually breaks out to the upside, signaling a potential continuation of the prior uptrend.