Close to Support Pattern

Description

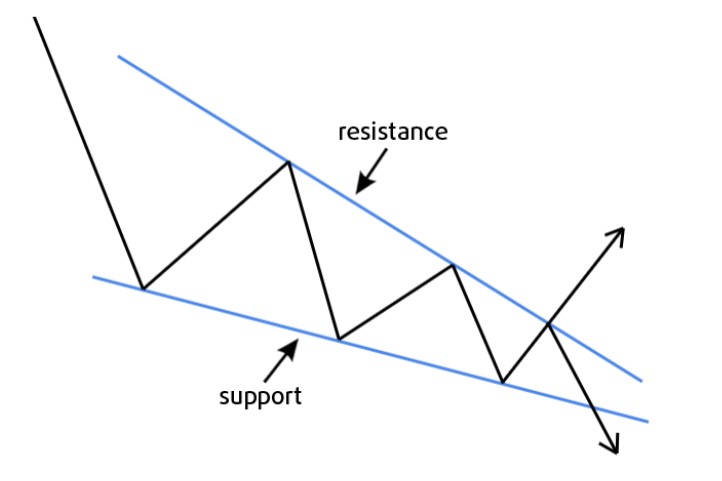

The "Close to Support" pattern occurs when the price of an asset approaches a known support level. Support is a price level where buying interest is strong enough to overcome selling pressure, potentially causing the price to bounce upwards.

How to Identify

- Look for a clear downward trend or a pullback in an uptrend.

- Identify a support level based on previous price reactions or significant lows.

- The current price should be approaching, but not yet touching, this support level.

Trading Strategies

Anticipatory Long Entry

Enter a long position as the price approaches the support level, anticipating a bounce.

- Entry: When price is within 1-3% of the support level, depending on the asset's volatility.

- Stop Loss: Just below the support level.

- Take Profit: Previous swing high or next resistance level.

Confirmation Long Entry

Wait for confirmation of the bounce before entering a long position.

- Entry: When price shows a reversal signal (e.g., bullish candlestick pattern) near the support.

- Stop Loss: Below the recent low or support level.

- Take Profit: Next resistance level or a predetermined risk-reward ratio.

Risk Management

Always use stop-loss orders to protect against unexpected market moves. The strength of the support level can be gauged by the number of times it has been tested. However, be aware that support levels can be broken, especially in strong trending markets or after significant news events.

Example

In this example, we can see the price approaching a well-established support level. Notice how the price has previously bounced off this level multiple times, indicating its significance.